If you mention "crypto lending" to an investor who survived 2022, you might see them wince. The scars from the collapses of BlockFi, Celsius, and Voyager are still fresh—billions of dollars evaporated not because Bitcoin failed, but because the centralized "black boxes" holding it were reckless.

The question lingering has been: Did we actually learn anything?

The data suggests we did. As of Q4 2024, the total crypto lending market has quietly recovered to $36 billion. But beneath that topline number, the structure of the market has fundamentally changed. Investors are no longer handing their keys to charismatic CEO’s at scale.

Bitcoin venture studio, Thesis, has put out an excellent 17-page report on the current state of Bitcoin lending.

The Great Migration: DeFi Eclipses CeFi

The most striking trend in the 2024 data is the flippening. No, not that stupid one from the ETHtards. Money is flowing into DeFi at a much higher rate than centralized lenders.

DeFi Boom: Decentralized lending has exploded nearly 1,000% from its bear market lows to reach $19 billion, surpassing its previous bull market peak.

TradFi is Limp: In contrast, the centralized sector sits at $11 billion, remaining 68% below its all-time high.

The market is voting with its feet (and its capital), prioritizing the transparency of on-chain protocols where collateral can be audited in real-time, over the convenience of “trust me bro” models of yesteryear.

The Price of Money: A Massive Arbitrage Opportunity

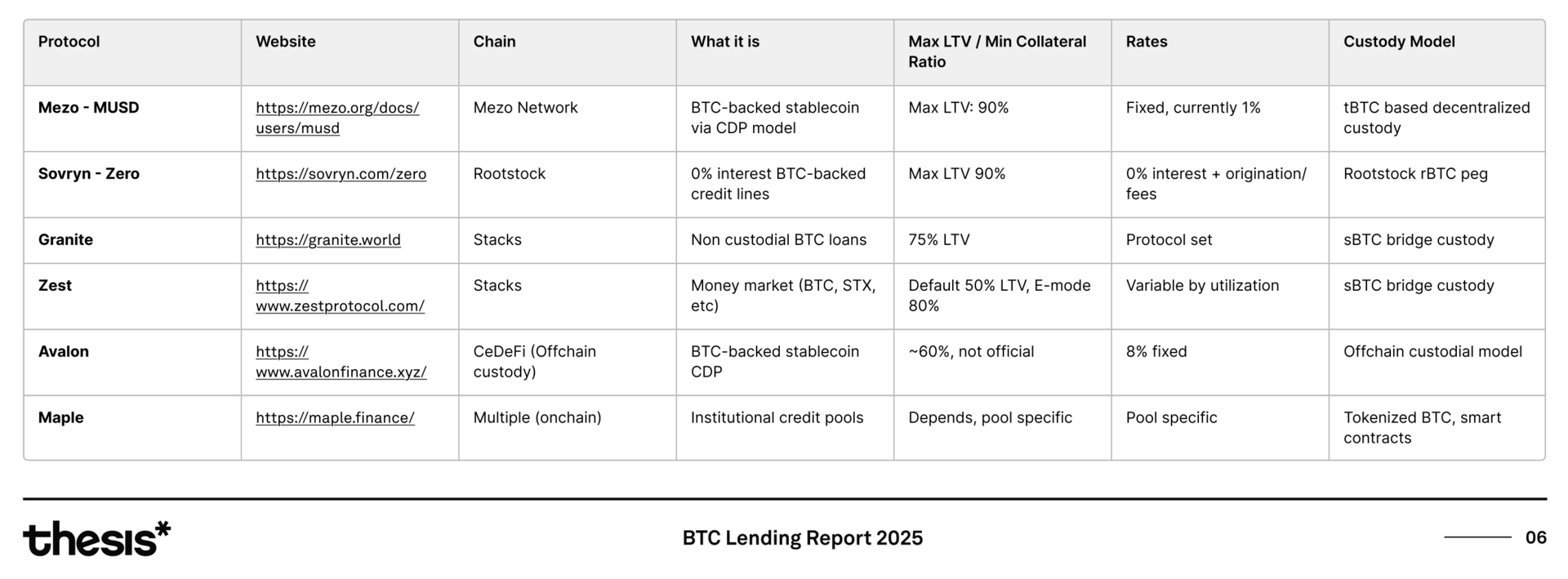

For those willing to navigate the complexities of on-chain finance, there is currently a massive efficiency gap in the cost of capital. A distinct disconnect exists between on-chain and off-chain markets:

Chart credit: Thesis Bitcoin Lending Report

On-Chain (DeFi): Borrowing stablecoins against Bitcoin currently averages around 5-6%

Off-Chain (CeFi/OTC): Institutional desks and private credit markets are charging between 10% and 12% (sometimes higher)

This 500+ basis point spread highlights the "institutional friction" that still plagues traditional finance. Another example where regular retail users get to front run the man with better tech.

The current big lingering problem is smart contract risk. In 2024 alone, an estimated $1.42 billion was lost across 150 incidents due to smart contract vulnerabilities. While self-custody solves the counterparty risk problem, going on-chain brings the headache that you might wake up to your funds being frozen, or worse, totally gone due to an exploit.

We could view the difference in interest rates marked above as the priced in cost of total loss due to smart contract risks. At least, it’s one contributing piece.

Not Spotify Wrapped

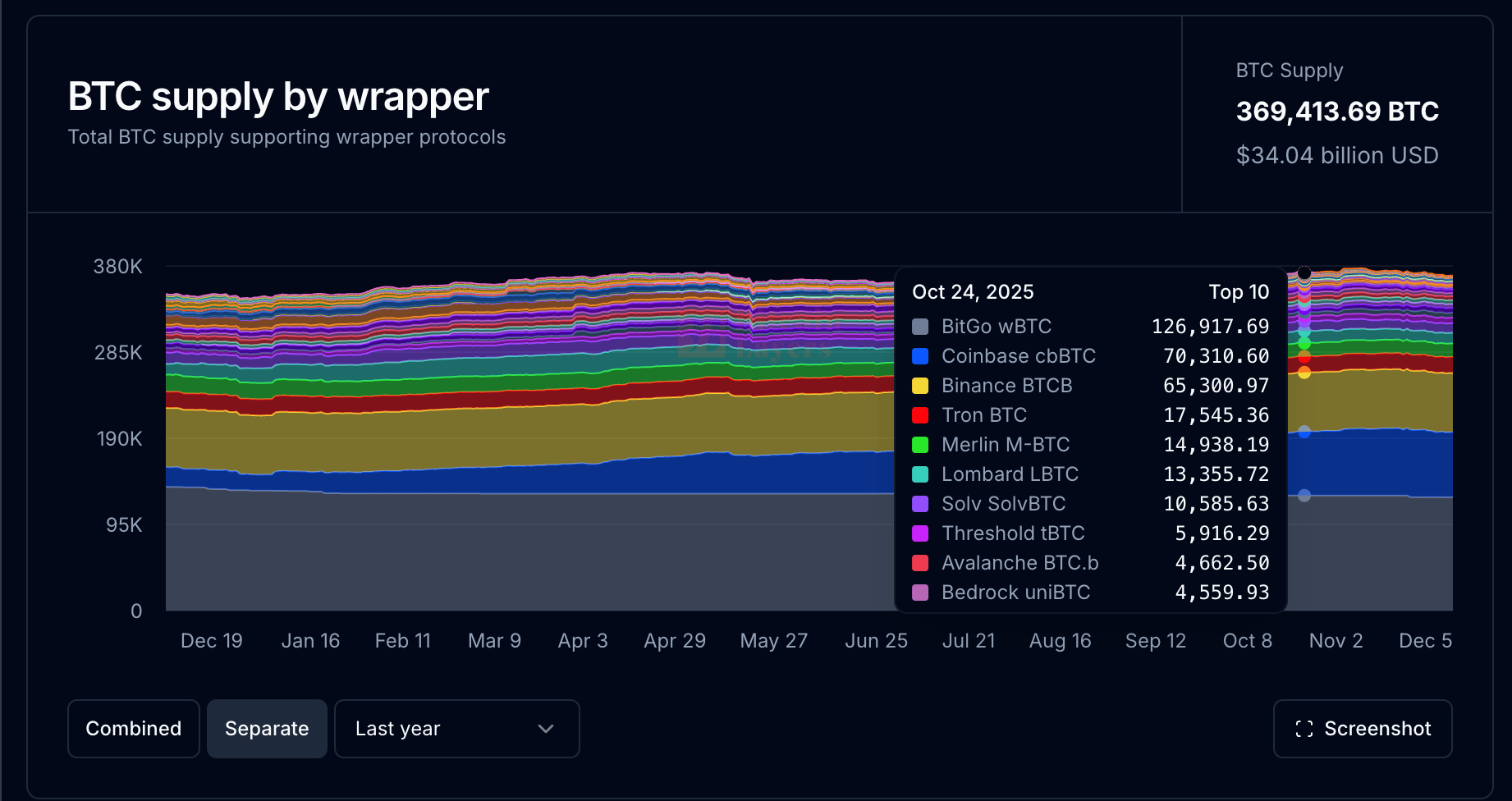

Here’s a crazy stat: A year ago, BitGo’s WBTC held a commanding supply of roughly 130,000 Bitcoin. Most of the wrapped BTC market. At that same time, Coinbase’s competing product, cbBTC, had just launched with a modest 20,000 in BTC.

Fast forward one year. BitGo’s supply is down 10,000 BTC. Meanwhile, Coinbase is up 50,000 BTC.

Chart Credit

This is one of the most aggressive shifts in the Bitcoin landscape. The fight for who holds the BTC deployed on chain and creates the market around them. All the current Bitcoin L2’s are fighting on this front as well. Selling “trust-minimized” bridges.

If the CeFi <> DeFi data above is any indicator. Bitcoin L2’s are in a good place to capture market share.

Conclusion

The Bitcoin lending market of 2025 is healthier, transparent, and significantly more efficient than the casino of 2021. The recovery to $36 billion proves that the demand for liquidity is real. However, the risks haven't disappeared—they've just mutated. We have swapped credit risk for code risk, and monopolies for fierce competition. The yield is real, but as the $1.42 billion in hack losses reminds us, so is the danger.

Read the full 17-page report from Thesis Here

Bitcoin Lending Market Analysis Q3 2025

BROUGHT TO YOU BY

BITFLOW FINANCE

Stop letting your Bitcoin gather dust. |

Most Bitcoiners are terrified of DeFi because of the hacks and the scams. Bitflow is different. The #1 DEX on Stacks lets you earn real BTC yield multiple ways— Once you bridge in, It’s built to be non-custodial from the start. |

Real Yield: No inflationary token printing. You earn from actual swap fees.

Boosted Yield: Dual Stacking let’s you earn ~5% for putting your BTC to work

HODLMM Soon: New DEX design means better slippage and more fees with less capital for LPs. This is bleeding edge that’s mostly been on Solana. 🔥