Good evening. This is Built on Bitcoin, the hottest newsletter to understand what’s happening in BTC land without sifting through whiny tweets about spam on the timeline.

If it isn’t in Musubi, we don’t care.

Here’s what we got today:

The Trojan Horse: Square turns 4M merchants into Bitcoiners overnight.

Lawsuit Alert: Maple Finance gets sued (and why it matters for your yield)

The "Cost Center" Fallacy: How Amboss is turning payment fees into profit.

🔥 Podcast 🚨: The "Holy Grail" of non-custodial loans with Lygos Finance.

Early access for newsletter readers.

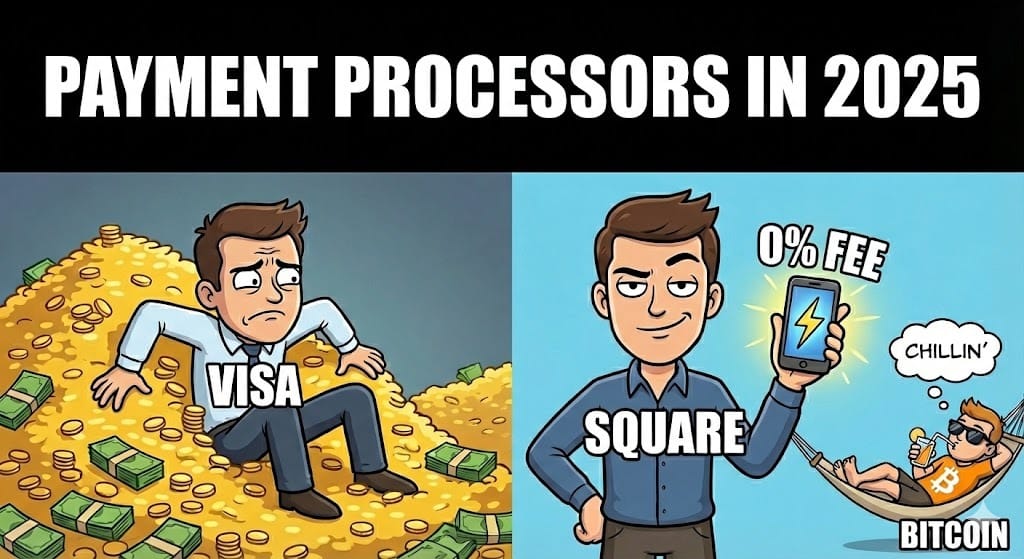

SQUARE IS COMING FOR THE CROWN

Stop waiting for mass adoption. The ultimate Trojan Horse is in play (and you can play a part)

The critique of Bitcoin payments has been "nobody accepts it." As of this week, that argument is on its last legs.

Block (Square) just flipped a switch that enables millions of US merchants to accept Lightning. They didn't ask for it. They didn't buy new hardware. It’s just... there.

They can auto-convert to fiat too if they want to choose foolishness.

The gangster part is Square is backing it up with a huge campaign to let random plebs to find merchants who are slacking, and get paid to get them to turn on Bitcoin payments. $25 in BTC per shop you convince. EASY MONEY

Oh! And the merchant pays 0% in fees for the entire year of 2026.

“LETS GO!” said everyone. Unless your a Visa big wig*

MAPLE FINANCE HAS TO PULL $150M YIELD PRODUCT

If you’ve been following us. You know we launched BitcoinYield a little over 2 months ago. Writing on exactly what it sounds like.

Well, two prominent crypto products are duking it out in the courts. The institutional CeDeFi company Maple Finance, and Bitcoin L2 Core are breaking up after announcing a partnership early this year.

And some hefty amounts of BTC are at risk. We’ll keep the details high level here but we wrote a deeper dive into the current known shenanigans over at BitcoinYield 🫡.

TODAY’S EDITION IS BROUGHT TO YOU BY

BITFLOW FINANCE

Stop letting your Bitcoin gather dust.

Most Bitcoiners are terrified of DeFi because of the hacks and the scams. Bitflow is different. The #1 DEX on Stacks lets you earn real yield from trading fees—without handing your keys to a centralized middleman. Once you bridge in, It’s built to be non-custodial from the start.

Real Yield: No inflationary token printing. You earn from actual swap fees.

Boosted Yield: Dual Stacking let’s you earn ~5% for putting your BTC to work.

HODLMM Soon: New DEX design means wayyy better slippage and more fees with less capital for LPs

Early Access Podcast: The "Holy Grail" of Loans

If your from the crypto vintage of 2021 and earlier, you might have PTSD from Celsius, BlockFi, and Terra Luna. Which sucks cause we want to borrow against our coins and buy that new Porsche, but we don't want to give them to a guy named Mashinsky.

In this episode with the co-founders of Lygos Finance:

How DLCs (Discreet Log Contracts) allow you to lock bitcoin in a vault that no one can touch without predefined conditions.

Why "Shared Custody" is the only way forward for institutional lending.

The future of capital markets with BTC at the heart.

And since we love you, dear reader. You get early access to the unlisted Youtube video before it goes live next week. The smallest thank you for reading and rocking with us 🙏

Quick Hits ⚡️

Amboss x Voltage: Imagine you can give the 🖕 to Visa and avoid crazy processing fees, and also have the balance chilling in your merchant account earn yield. That’s what Amboss & Voltage just cooked.

OP_CAT is coming 🤔: StarkWare's CEO says the controversial upgrade could be live within 12 months. Sure bro.

Cloudflare Outage: Half the internet broke on Tuesday. Bitcoin produced a block every 10 minutes. Unphased. Moisturized. In My… You get it.

Bitcoin Merchants Go Up: BTC Map added their 1,000th Bitcoin merchant 🥳

95%: Yes, we are officially less than 5% BTC left to be mined. I hope we figure out this fee problem soon! :fake quake in boots:

Jake’s Take

I’ll be honest. I see a lot of bearish sentiment on the timeline. From price action, to certain L2’s not performing well, or normies/retail nowhere to be scene. Blah blah blah.

The thesis of Bitcoin deeply entrenching itself in the system people use everyday has never been stronger. As I look around the ecosystem and talk with people day to day, the fundamentals look incredibly strong. Bitcoin has never been better.

You just have to expand your time horizon past the average pump.fun trader aka goldfish. 2026 looks like a fun time. Onward.

BitcoinCash Jr. MEME OF THE DAY

“Hello, FBI? Yes, I’d like to report my neighbor. I believe he’s been relaying salacious things on The Bitcoin Internet.”

VISA. IS. FCKED

See you Monday, The Built on Bitcoin Team ✌