We're Bitcoiners. We don't use Ethereum. Right?

Well, Babylon, the BTC staking protocol, has been working at the bleeding edge of ways to lock BTC and then execute actions on other chains in a safer way. A few months ago, they released a whitepaper on trust-minimized (though they argue it's trustless) vaults.

This laid the groundwork for the loan product coming soon.

Aave and Babylon announced a partnership targeting a live launch in Q2 of 2026.

This will allow you to lock your BTC on the Bitcoin L1, and then take a loan on Aave on Ethereum to get USDC or stablecoins on that chain.

Why is this important?

Aave has the deepest liquidity pools in all of crypto. Borrow rates are currently around 5% for USDC. It’s a fact that on-chain DeFi simply gives you access to the lowest rates across the market.

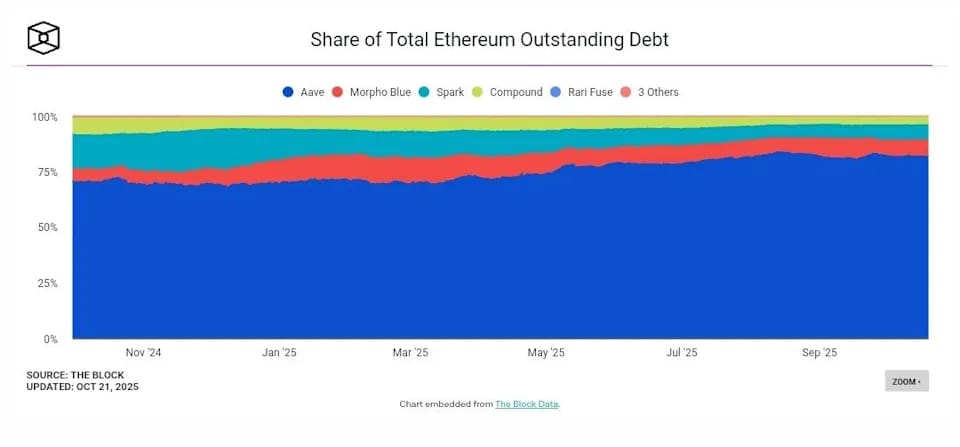

Looking at on-chain data, Aave absolutely dominates. Aave IS lending. Over 80% of outstanding DeFi debt is currently on Aave.

This matters because one of the biggest narratives right now is how much dormant BTC is staying on the sidelines due to the bridge risk involved with most loan products. If this works as described, we'll have a specific data point for how much idle BTC is willing to come on-chain for DeFi yields or loans.

Some nerdy stuff: It's important to distinguish between "trust-minimized" and "trustless," terms that get thrown around a lot.

I haven't deep-dived into the code yet, but this is based on BitVM3. This means there is a trust assumption. Given the technical complexity, the average user will not be submitting their own proofs. Instead, you are relying on a "1-of-N" trust model—meaning you need at least one honest operator (or "watcher") to keep the system honest, rather than trusting a single centralized custodian or yourself.

TODAY’S EDITION IS BROUGHT TO YOU BY

BITFLOW FINANCE

Stop letting your Bitcoin gather dust. |

Most Bitcoiners are terrified of DeFi because of the hacks and the scams. Bitflow is different. The #1 DEX on Stacks lets you earn real BTC yield multiple ways— Once you bridge in, It’s built to be non-custodial from the start. |

Real Yield: No inflationary token printing. You earn from actual swap fees.

Boosted Yield: Dual Stacking let’s you earn ~5% for putting your BTC to work

HODLMM Soon: New DEX design means better slippage and more fees with less capital for LPs. This is bleeding edge that’s mostly been on Solana. 🔥